-

December 26, 2025

-

10 min read mins read

-

0 Comments

Documents Required for VAT Registration In The UAE

Navigating the VAT registration process in the UAE can be a daunting task. Understanding the required documents is crucial for a smooth experience.

Businesses must comply with UAE tax regulations to avoid penalties. and fines This guide will help you gather the necessary documents for VAT registration.

We’ll also explore the timeline for completing the process. Knowing what to expect can save you time and effort.

Whether you’re a business owner or financial professional, this information is vital. Stay informed to ensure your business remains compliant with UAE VAT requirements.

Summary

This guide outlines who must register for VAT in the UAE, the documents you’ll need, the steps to apply via the FTA portal, and typical processing times. Core documents include copies of your passport and resident permit, trade license, incorporation/Decree documents, authorized signature letter, and signed request/application letters, with financial statements or activity evidence as applicable. Applications are filed online and, if complete and accurate, are generally processed in about 20 business days, though timing can vary. After approval, you receive a VAT certificate and number, enabling you to charge VAT and requiring proper invoicing, record-keeping, and timely filings.

What is VAT and VAT Registration?

Value Added Tax (VAT) is a consumption tax imposed on the sale of goods and services in the UAE. This tax is collected at each stage of the supply chain, where value is added, allowing businesses to reclaim VAT paid on their purchases. VAT was introduced in the UAE on January 1, 2018, at a standard rate of 5%.

VAT registration is the process through which businesses officially register with the Federal Tax Authority (FTA) to collect and remit VAT. It is mandatory for businesses whose taxable supplies exceed AED 375,000 annually. Once registered, businesses receive a Tax Registration Number (TRN) and must comply with VAT laws, including filing periodic returns and maintaining proper records.

This ensures transparency in tax collection, compliance with regulations, and contributes to the national revenue.

Who needs to register for VAT in the UAE?

In the UAE, VAT registration is essential for certain businesses. Mandatory registration applies to those meeting specific turnover thresholds.

If your taxable supplies exceed AED 375,000 annually, you must register. Voluntary registration is available if your supplies exceed AED 187,500 but are below the mandatory threshold.

Here’s a brief list of who needs to register:

- Businesses with taxable supplies over AED 375,000 annually

- Voluntary registration for supplies above AED 187,500

- Businesses importing goods exceeding AED 187,500

Overview of the UAE VAT registration process

The VAT registration process in the UAE is overseen by the Federal Tax Authority (FTA). Businesses must complete this process online through the FTA portal. Understanding the steps and requirements ensures a smooth application.

First, create an account on the FTA portal. Gather all necessary documents before starting the application process. This step reduces any delays caused by incomplete applications.

Here is a basic overview of the process:

- Create an FTA account

- Gather necessary documents

- Submit the online application

Once submitted, the process usually takes about 20 business days. However, the timeline may vary depending on the submission’s completeness and accuracy.

Importance of VAT Registration for Businesses

Completing the VAT registration process ensures the business is officially listed with the government, indicating that the company is active in sales and production. Upon successful VAT registration, businesses gain significant advantages, including the ability to reclaim any VAT paid on company purchases. This not only facilitates cash flow but also improves financial management within the business.

Once registered, a business takes on several important responsibilities:

- Imposing VAT on Goods and Services: All applicable goods and services sold by the business must include VAT charges. This ensures compliance with tax regulations and accurate accounting.

- Submission of VAT Returns: Registered businesses are required to submit regular VAT returns through the Federal Tax Authority (FTA) portal, detailing sales and VAT collected, as well as purchases and VAT paid. Accurate submission is crucial to avoid penalties.

- Maintaining a VAT Account and Records: It is essential for businesses to keep detailed records of all VAT transactions. This includes sales invoices, purchase receipts, and records of VAT collected and paid, which are necessary for audits and compliance checks.

VAT registration is completed online via the FTA portal. Upon approval, businesses will receive a Tax Registration Number (TRN), which must be displayed on all sales invoices. This TRN serves as a unique identifier for the business in tax matters and is essential for maintaining compliance.

It is imperative for every business to adhere to VAT registration requirements, ensuring they have a TRN and meet all ongoing obligations under UAE tax law. This commitment to VAT compliance not only fosters trust with authorities but also enhances the overall reputation of the business.

Documents Required for VAT Registration In The UAE

VAT registration in the UAE requires several essential documents. Gathering the documents required for VAT registration in the UAE in advance will facilitate a smoother registration process.

These documents help prove the business’s legitimacy and demonstrate its operational status. They also provide financial details needed for VAT evaluation.

The list of documents often varies based on business type and operational specifics. However, some remain mandatory for all applicants.

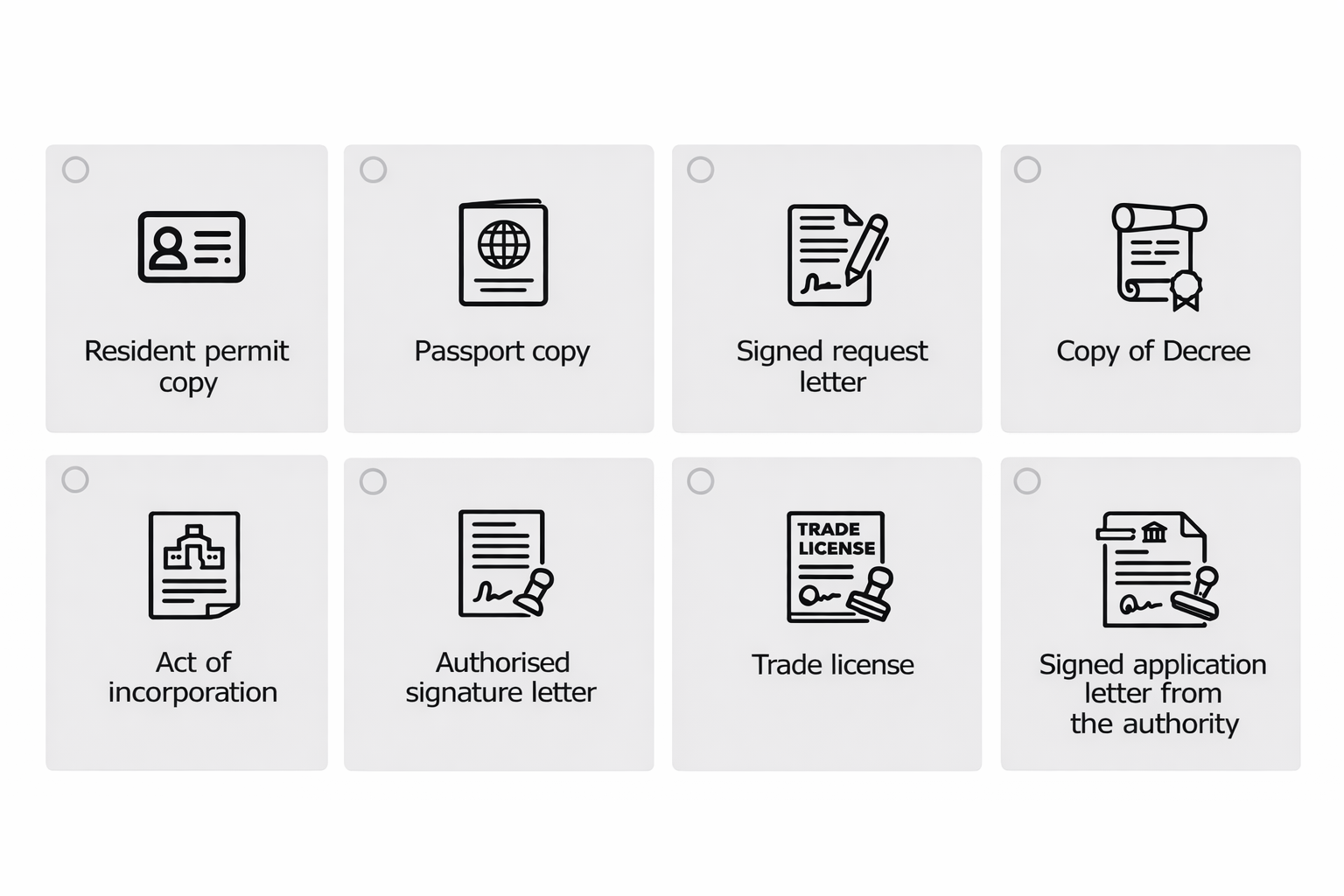

Mandatory documents for all businesses

Every business must submit certain documents to register for VAT. Ensuring these are ready can prevent delays.

Key mandatory documents include:

- Resident permit copy

- Passport copy

- Signed request letter

- Copy of Decree

- Act of incorporation

- Authorised signature letter

- Trade license

- Signed application letter from the authority

These documents establish identity, location, and legal compliance. Providing correct and current versions is crucial.

Additional documents based on business type or activity

Certain businesses may need to present additional documents. This depends on their industry or operations.

For example, financial documentation is often requested. It helps verify business turnover.

Additional documents might include:

- Financial statements

- Balance sheets

- Evidence of business activities

Submitting accurate documents supports the registration process. Ensuring all papers reflect current information is vital for compliance.

Step-by-step guide to submitting your VAT registration application

Filing a VAT registration application in the UAE can be streamlined with a clear approach. The process is largely online, making access simple for businesses.

Begin by visiting the Federal Tax Authority (FTA) portal. Create an account if you do not already have one.

Once logged in, navigate to the VAT registration section. Follow the prompts to start your application.

Here’s a step-by-step breakdown:

- Create an FTA account: Access the portal, providing initial business details.

- Fill out the application: Enter the necessary information carefully.

- Upload required documents: Attach all mandatory and, if applicable, additional documents.

- Review: Carefully check all details and entries.

- Submit your application: Confirm submission and record the reference number for tracking.

This process typically takes about 20 business days for the FTA to process. Ensuring accuracy in each step can help avoid unnecessary delays.

How long does the VAT registration process take?

The duration of the VAT registration process in the UAE can vary. Typically, applications are processed within 20 business days. However, this timeframe is dependent on several factors.

Delays may occur if the application is incomplete or if additional information is required. It’s essential to ensure all details and documents are correct before submission to avoid holdups. Monitoring your application status via the FTA portal can help track progress.

Key time factors include:

- Completeness of application

- Accuracy of provided details

- Prompt response to FTA queries

What happens after VAT registration is complete?

Once VAT registration is approved, businesses receive a VAT certificate. This document confirms your VAT registration status and includes your unique VAT registration number.

With this certificate in hand, businesses can legally charge VAT on goods and services. It’s crucial to integrate this VAT number into your financial documentation to ensure compliance.

Important steps post-registration:

- Incorporate VAT number in invoices

- Maintain accurate VAT records

- Adhere to VAT filing deadlines

Common mistakes to avoid during VAT registration

VAT registration can be tricky, with potential pitfalls for businesses. Understanding common errors helps in avoiding these hurdles.

Mistakes often include:

- Incomplete documentation

- Incorrect business activity declaration

- Missing financial records

To prevent these, double-check your documents and ensure complete and accurate submissions. This diligence saves time and avoids delays.

Ensuring VAT compliance after registration

Once registered, maintaining VAT compliance becomes essential. This ensures your business operates smoothly and meets legal requirements.

Key compliance tasks include:

- Accurate record-keeping

- Timely VAT return filing

- Regular review of VAT regulations

Effective compliance minimizes risks of penalties and enhances your business reputation. Always stay informed about any changes in VAT laws.

Where to find help and official UAE VAT guides

Navigating VAT requirements can be complex. Fortunately, resources are available to assist businesses through the process.

For detailed guidance, consider:

- Consulting the Federal Tax Authority‘s website

- Reviewing official VAT guides

- Engaging a professional tax consultant

These resources offer valuable insights into compliance and help answer your VAT-related questions. Always rely on official sources for accurate information.

Final Note:

When navigating VAT registration in Dubai, businesses have a variety of options, including the convenience of completing forms online. Utilizing VAT registration services in Dubai can significantly simplify the process, particularly when you work with reputable VAT consultants in the UAE.

Once your company successfully completes the registration, you’ll receive a VAT certificate, signifying your compliance with social responsibility. For more information on VAT registration in the UAE and how Tax consultants in Dubai can assist you through the process, feel free to reach out to us.

FAQs

1. What is a VAT certificate in UAE?

A VAT certificate is an official document issued by the Federal Tax Authority (FTA) that confirms a business’s registration for Value Added Tax (VAT) in the UAE. This certificate contains crucial information, such as the business’s Tax Registration Number (TRN) and the effective date of VAT registration. It serves as evidence of compliance with VAT regulations and is essential for businesses to charge VAT on their goods and services.

2. What are the penalties for failing to file VAT returns in the UAE?

Failing to file VAT returns on time can result in significant penalties under UAE tax law. For a first-time offense, the penalty is AED 1,000, and if the failure to file repeats within a 24-month period, the penalty increases to AED 2,000. Additionally, continued non-compliance may lead to further fines and legal consequences.

3. Is there a VAT refund process for businesses?

Yes, businesses registered for VAT in the UAE can claim refunds on VAT paid for eligible purchases related to their business activities. To initiate the refund process, a business must submit a VAT refund application through the FTA portal as part of their VAT returns, outlining the total VAT paid and collected. Refunds are typically processed within a specified timeframe, depending on the completeness of the application.

4. What should I do if my VAT application is rejected?

If your VAT application is rejected, the Federal Tax Authority (FTA) will usually provide reasons for the rejection. To address these issues, you should carefully review the feedback, make the necessary corrections, and resubmit your application. It may be beneficial to consult with a tax professional or consultant for guidance to ensure compliance and increase the chances of approval on resubmission.

5. Are there exemptions for small businesses regarding VAT registration?

Yes, small businesses with an annual turnover of less than AED 187,500 are not required to register for VAT. However, they have the option to register voluntarily if they anticipate exceeding this threshold or wish to reclaim VAT paid on business-related expenses. It is important for such businesses to understand their specific tax obligations and take necessary actions based on their financial activities.